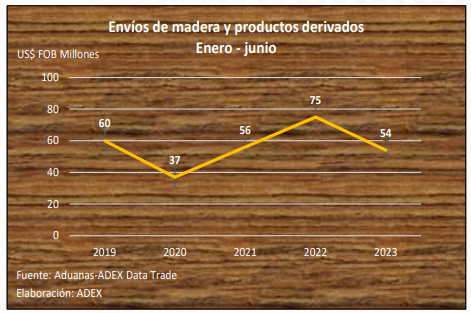

Wood and its derived products shipments between January and June amounted to US$ 54 million 312 thousand, indicating a decline of -28.3% compared to the same period in 2022 (US$ 75 million 765 thousand), as reported by the Management of Services and Extractive Industries of the Association of Exporters (ADEX).

This contraction is partly explained by lower orders from its two main buyers, France (US$ 10 million 748 thousand) and China (US$ 10 million 740 thousand), which decreased their demand by 21.7% and 29.5%, respectively.

In the case of France, the increase in the price of Peruvian wood makes it less competitive compared to suppliers from other countries, such as Brazil or Russia. Regarding China, the real estate sector is undergoing an increasingly deep crisis with a growing risk of default among some developers seeking to sell apartments.

Other destinations included Mexico (US$ 8 million 220 thousand), with an increase of 50.2%, the Dominican Republic (US$ 5 million 737 thousand) with a reduction of -40.4%, and the USA (US$ 3 million 869 thousand) with a contraction of -33%. Completing the top ten were Belgium (US$ 2 million 965 thousand), Ecuador (US$ 2 million 391 thousand), Vietnam (US$ 1 million 922 thousand), Denmark (US$ 1 million 511 thousand), and Chile (US$ 916 thousand 009).

Wood and its derived products shipments between January and June 2023 represented only 0.1% of Peru’s total exports.

According to figures from the ADEX Data Trade Commercial Intelligence System, semi-manufactured products were the most relevant, totaling US$ 22 million 379 thousand, with a decrease of -42.4%. Second in the ranking was sawn wood, reaching US$ 21 million 869 thousand, despite falling -16.8%.

Others included construction products (US$ 2 million 618 thousand); firewood and charcoal (US$ 2 million 188 thousand); furniture and its parts (US$ 1 million 796 thousand); manufactured products (US$ 1 million 463 thousand); veneer and plywood (US$ 1 million 220 thousand); and sheets, plates, and foil (US$ 649 thousand 450), among others.

In the first 6 months of the year, the most important exporting companies were Maderera Bozovich, IMK Maderas, Grupo Maderero Amaz, Consorcio Maderero, and Industria Forestal Huayruro.

Annual

In 2022 (January-December period), shipments reached US$ 126 million 489 thousand, achieving a growth of 2.5% compared to 2021 (US$ 123 million 315 thousand). While the FOB amount for last year was the highest in the last 5 years, it still does not surpass that of 2014 (US$ 170 million 976 thousand), 2010 (US$ 172 million 147 thousand), and 2008 (US$ 219 million 239 thousand).

The countries that demanded the most wood products in 2022 were China (US$ 24 million 273 thousand), the Dominican Republic (US$ 18 million 141 thousand), France (US$ 17 million 585 thousand), Mexico (US$ 13 million 521 thousand), the USA (US$ 11 million 680 thousand), among others.

In the first semester of the year, 47,538 tons of wood products were exported.